Chicago VC Fundraising Summary 2021

CHICAGO VC FUNDRAISING SUMMARY

—

2021

—

CHICAGO VC FUNDRAISING SUMMARY — 2021 —

Chicago is a global innovation hub. With resources like 1871, Built-In Chicago, and the Illinois Tech Association (ITA), and a generously collaborative network of business leaders, it’s no surprise that plenty of venture capital firms have found Chicago to be a rich breeding ground for smart investments. Many of our clients have received or are preparing for VC funding. Our clients sparked our interest in monthly fundraising announcements, and now it has become a routine highlight which we excitedly await. HirexHire has expertise in implementing hiring strategies for start-up company growth. Do You Need Recruitment Support to Build Your Team? Contact Us.

2021 Chicago Startup Seed and Venture Capital Fundraising Summary

Chicago Startups Raised Over $641M in Q4 2021

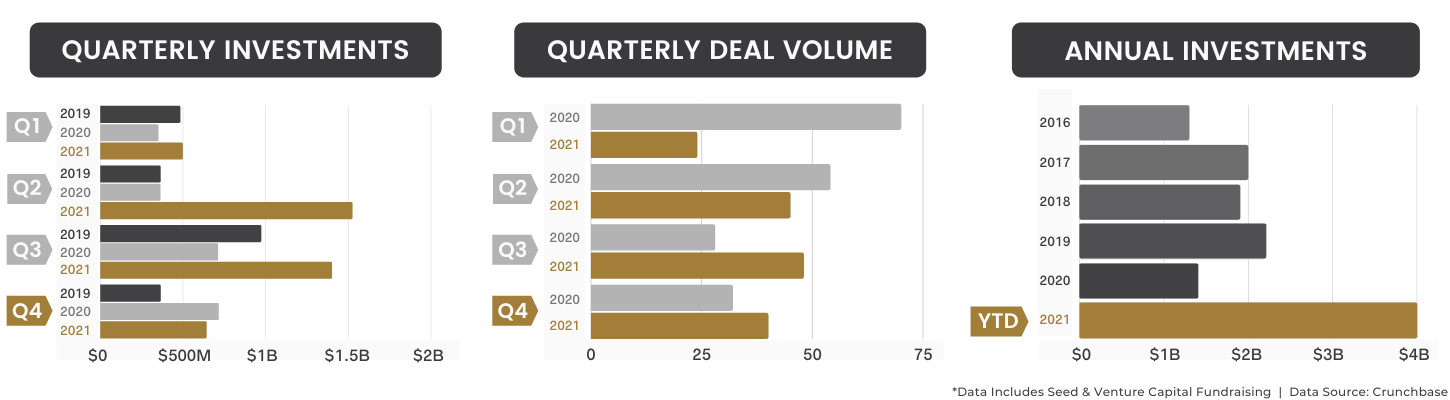

The Chicago startup scene continued to broker investment deals through the end of last year. 40 startups raised over $641.5M in seed and venture capital in Q4 of 2021, closing the total annual investment at $3.98B. This sum more than doubles the $1.4B raised in 2020 and far exceeds the $2.2B raised in 2019.

The largest deals of Q4 were $100M Series C financing raised by Halo Investing, $90M Series B investment by Tegus, and $80M Series C round by The Mom Project.

HirexHire is a proud participant and supporter of Chicago’s tech business growth. If you’re looking for a job in rapid-growth Chicago tech, view our current open job board. If you are looking for support hiring for your company after a round of fundraising, contact our team to discuss the next steps.

Chicago startups closed out 2021 by raising over $87 Million in Seed and Venture Capital investment deals in December

Crypto-investing software startup, Stacked, closed the top deal in December, raising $35M in Series A Funding, and has since announced intentions to use the funds to double its 40-person team and build out its suite products. Another fintech investment company – Diffuse, a platform of cherry-picked emerging funds – raised about $2.675M.

The Desire Company, a product advice library curated by industry professionals, also announced plans to aggressively hire in Q1 of 2022 with a focus on opening a new studio in Chicago and expanding its Chicago, Atlanta, and Los Angeles teams across roles in sales, marketing, and tech. offers Chicago-based data usage monitoring and tracking specialist Tractiv has raised $2.25 million in seed funding and plans to expand its engineering and sales teams.

Two medical tech companies raised funds in December: medical device company Surgical Innovation Associates, Inc. (SIA) virtual process improvement platform for healthcare revenue cycles, Janus.

In December, we also saw deals closed by cybersecurity company UncommonX and Trala, a developer of a music education application used to teach users to play the violin.

View December fundraisers below:

Stacked — $35M | Series A

Surgical Innovation Associates — $15M | Series B

UncommonX — $9.5M | Series A

The Desire Company — $8M | Series A

Janus Health — $8M | Series A

Trala — $6.9M | Venture - Series Unknown

Diffuse — $2.7M | Venture - Series Unknown

Tractiv — $2.25M | Seed

Congratulations to all November dealmakers! Visit the links below to learn more about each company and explore their open roles:

Tegus — $90M | Series B

Hallow — $40M | Series B

Fyllo — $40M | Series C

ThreeKit — $35M | Series B

FingerprintJS — $32M | Series B

Hirewell — $21M | Venture - Series Unknown

GeoWealth, LLC — $19M | Series B

Cohesion — $15M | Series A

Logik.io — $10M | Seed

UncommonX — $8.08M | Venture - Series Unknown

Hologram — $6.8M | Series B

The Small Exchange — $5M | Venture - Series Unknown

EarlyBird — $4M | Seed

BUNDLAR — $2.81M | Seed

PressPage — $2.32M | Venture - Series Unknown

Cypher — $2.1M | Seed

WORDEGO — $450K | Seed

HumanCore — $250K | Seed

Chicago Startups Raised Over $333M in Venture Capital Deals in November 2021

Throughout November, 18 Chicago tech startups raised over $333M in Seed and Venture Capital deals. Multiple companies have since announced plans to use funds to hire hundreds of new employees in the coming year. The key themes we saw in November were FinTech, Cyber Security, Crypto, NFTs, and Augmented Reality.

Fintech startups -- Tegus, GeoWealth, Cypher, The Small Exchange, and EarlyBird -- plan to add nearly 500 jobs to support their growth. Tegus, a FinTech research and data startup, raised a $90M Series B round led by Oberndorft Enterprises and Willoughby Capital and has said it plans to hire more than 400 employees next year, more than doubling its headcount. Enterprise software platform for independent advisers, GeoWealth, plans to hire up to 60. Non-traditional FinTech firm, Cypher, raised $2.1 million from crypto venture firms Sino Global, SkyVision, and Blockwall. Cypher, the upstart protocol, plans to start trading synthetic futures contracts tied to restricted assets like pre-public stocks or upcoming token sales.

Two startups are raising funds to support Augmented Reality. Threekit’s software creates ultra-realistic online 3D images of everything from couches to diamond rings, giving e-commerce customers a much better idea of what they're about to buy. Threekit also enables brands to create products that can be minted and sold to people as NFTs. SaaS company, BUNDLAR raised Seed funding to support its Augmented Reality Content Management System.

Two cyber security companies raised funds in November. FingerprintJS helps prevent fraud, spam, and account takeovers with their highly accurate browser fingerprinting service. UncommonX offers cybersecurity protection for organizations by combining threat and intelligence software with 24/7 industry experts.

One of the top dealmakers in November was Hallow, a Catholic prayer, and meditation app. Hallow announced plans to use the funds to scale hiring to double its team and to continue partnership and content development.

Additional fundraisers include modern CPQ configuration solution, Logik.io; employee growth and prosperity platform, Humancore; and content-sharing-platform technology provider for social newsrooms, Presspage.

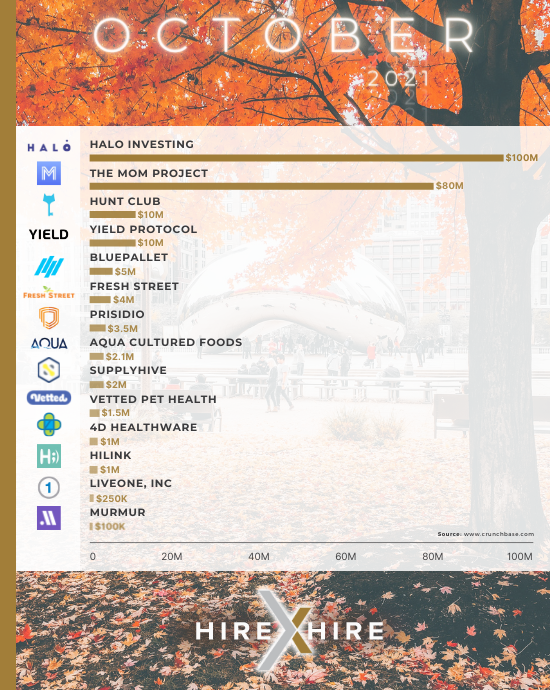

Chicago Startups Raised Over $220M in Venture Capital Deals in October 2021

Fourteen Chicago startups raised roughly $220M in Seed and Venture Capital deals in October 2021. A few highlights include a record-breaking investment for women, using tech for inclusivity, food innovation, and information centralization.

The Mom Project closed an $80M Series C round which “represents the largest global investment ever made in female workforce technology.”

4D Healthware, Halo Investing, and HilLink are all using technology to equalize access to quality services for all. “4D Healthware is on a mission to provide quality healthcare to all with a keen interest in providing services to the poor and disadvantaged.” Halo Investing is “committed to closing the wealth gap by giving individuals access to innovative investments to help them achieve their financial goals." And, HilLink’s mission is “to democratize education by making it available to everyone at an affordable cost.”

Two companies are redefining standards for food. Aqua Cultured Foods has developed the first whole-muscle cut sushi-quality seafood alternatives created using microbial fermentation, and Fresh Street is launching physical grocery stores built entirely for online orders and pickup—no in-store shopping. Chef’s kiss, Chicago.

SupplyHive and Prisidio each developed software to centralize critical information in one digital system. SupplyHive is focused on B2B supplier management and Prisidio supports individuals by digitizing important life files like wills and medical records.

View October fundraisers below:

Halo Investing — $100M | Series C

The Mom Project — $80M | Series C

Hunt Club — $10M | Series A

Yield Protocol — $10M | Seed

BluePallet — $5M | Venture - Series Unknown

Fresh Street — $4M | Seed

Prisidio — $3.5M | Seed

Aqua Cultured Foods — $2.1M | Pre-Seed

SupplyHive — $2M | Seed

Vetted Pet Health — $1.5M | Seed

4D Healthware — $1M | Venture - Series Unknown

HiLink — $1M | Pre-Seed

LiveOne, Inc. — $250K | Venture - Series Unknown

Murmur — $100K | Pre-Seed

Chicago Startups Raised Over $1.3B in Q3 2021

Startups and investment firms were busy brokering deals in Q3 of 2021. Chicago startups raised over $1.3B across 48 seed and venture capital deals. This brings the 2021 YTD fundraising investment up to $3.3B, far exceeding historical annual totals.

In Q3, Chicago brokered the most deals since Q2 of 2020. We also witnessed the largest deal of the year: an impressive $350M Series C financing raised by Nature’s Fynd. Other top deals this quarter include a $150M Series E investment raised by M1 Finance and a $140M Series C round by Copado.

New funds are reportedly being used for product upgrades, location expansions, and hiring strategies to sustainably scale amid the great resignation. If you need help with recruiting after fundraising, contact us to discuss your talent requirements.

Chicago Startups Raised Over $423M in Venture Capital Deals in September 2021

September dealmakers closed an above-average monthly fundraising sum of $423M across 18 Seed and Venture Capital deals. New fundraising enables product interactions, global expansions, and hiring.

We continue to see significant investments made in tech and SaaS startups. And in September, multiple deals were made to fund medical startups including treatment for OCD, a biopharmaceutical company focused on discovering and developing medicines for neurodegenerative diseases, digital solutions to elevate pelvic health, and cloud software for life science companies.

Learn more about each company and view open roles:

Copado — $140M | Series C

Vanqua Bio — $85M | Series B

Provi — $75M | Series C

Zero Hash — $35M | Series C

Blockware Mining — $34M | Venture - Series Unknown

NOCD — $33M | Series B

Civis Analytics — $30.7M | Series B

Vodori — $7.5M | Series A

CircleIt — $5.1M | Series A

Thoughtful Automation — $5M | Seed

Domination Finance — $3.2M | Seed

Innovare — $3M | Seed

General Lattice — $1M | Pre-Seed

StoryBolt — $1M | Seed

Oars + Alps — $1M | Venture - Series Unknown

AgTech Holdings Inc — $999K | Seed

Renalis — $824K | Pre-Seed

It's Your Serve — $340K | Seed

Chicago Startups Raised Over $207M in Venture Capital Deals in August 2021

August dealmakers made history in Chicago. Last month, Chicago startups raised $207,745,000 in seed and venture funding across 16 deals, bringing the year-to-date total to over $2.8B. Chicago startups have now doubled the total funds, $1.4B, raised in 2020. Chicago continues to see significant growth in SaaS, FinTech and other digital B2B organizations.

New funding will help grow SaaS usage, market awareness, and product improvements and expansions. And new funding equals new jobs. So far, Hologram has announced plans to triple its team after securing $65M, led by Tiger Global.

If you want to join one of these growing companies, click the links below to view open roles at each company. Or, contact HirexHire to learn about similar roles within rapid-growth Chicago tech.

Congratulations August deal-makers:

Hologram — $65M | Series B

Klover — $60M | Series A

High Definition Vehicle Insurance — $32.5M | Series B

Leap — $11M | Series A

Betsperts — $6M | Series A

CircleIt — $5.1M | Series A

HAAS Alert — $5M | Seed

BluePallet — $5M | Venture - Series Unknown

Lextegrity — $5M | Venture - Series Unknown

Clinify Health — $3.1M | Seed

Anthill AI — $3M | Seed

Call Center Studio — $3M | Venture - Series Unknown

ML Tech — $1.75M | Seed

FranShares — $1.42M | Pre-Seed

Super.tech — $500k | Pre-Seed

NuCurrent — $375k | Venture - Series Unknown

Chicago Startups Raised $684M in Venture Capital Deals in July 2021

In July, Chicago raised $684M in seed and venture capital funding across 14 deals. This is the second greatest monthly round-up of investments this year. We saw three major raisers that made 9-digit deals — Nature’s Fynd, M1 Finance, and LogicGate.

In the last few months, a majority of deals have been B2B service-based and technology organizations. However, in July, we saw a notable number of deals made by B2C product and service organizations, including Veo (micro mobility shared-use scooters and bikes), Nature’s Fynd (microbe-based proteins for meat substitutes and dairy substitutes), M1 Finance (robo-advisory financial and investment services), SongFinch (personal song creation), Intuitap Medical, Inc. (medical device), PechaKucha (visual storytelling), CircleIt (digital time capsule technology), and Crowded (application to aggregate technologies).

Most organizations have shared plans to use the newly secured funding for product enhancements and business expansions. Join us in celebrating these Chicago brands.

Learn more and view open jobs at each company by following the links below.

Nature's Fynd — $350M | Series C

M1 Finance — $150M | Series E

LogicGate — $133M | Series C

Paro — $25M | Series B

Veo — $16M | Series A

IntuiTap Medical, Inc — $5.5M | Series A

86 Repairs — $5.3M | Seed

CircleIt — $5.05M | Series A

Instant Connect — $4.4M | Seed

BravoTran — $2.8M | Seed

PechaKucha — $2.7M | Seed

SupplyHive — $2M | Seed

Songfinch — $2M | Seed

Crowded — $250K | Pre-Seed

Chicago Startups Broke Fundraising Records in Q2 2021

Q2 2021 broke multiple records for Chicago. To start, Chicago startups raised over $1.7B in seed and venture capital across 45 deals. This investment total is more than the annual sum of Chicago startup capital in all of 2020. The Q2 record-breaking sum brings the annual fundraising investment up to $2.19B — a total greater than most of the recent years in Chicago startup history.

Another notable milestone related to the increase in mega deals is that Chicago is now home to 19 unicorn startups (companies valued over $1B). In June alone, 8 of these companies earned the title.

The top deals made in Q2 of 2021 include ActiveCampaign’s $240M Series C Venture, project44’s $202M Series E Venture, Clearcover’s $200M Series D Venture, and ShipBob’s $200M Series E Venture.

Now is an exciting time to work in the Chicago startup space. Contact us if you need help building your rapid-growth company hire by hire.

Chicago Startups Raised Over $582M in Venture Capital Deals in June 2021

Chicago continued to close 9-digit deals last month. In total, Chicago startups secured over $582M in seed and venture capital funding across 9 deals.

B2B Software and technology continues to rule the startup space this month with a focus on data, asset management, and security. Two companies that stand apart from the group are Rise Science and Spotivity. Both organizations are lifestyle B2C technologies - Rise Science uses data to learn your unique biology to inform on improved sleep habits, and Spotivity is a platform designed to connect teens with programs that best suit their interests or needs.

The top deals pushed three companies to the $1B threshold, creating three new Chicago unicorn startups: ShipBob, project44, and G2. As of the end of June, Chicago became home to 16 unicorns startups in total.

Oak9 has announced its new funds will support the launch of its infrastructure as code security platform. Rheaply intends to use the funds to build carbon-based reporting into its climate tech platform. Edgemode will continue to expand its High-Performance Computing (HPC) Infrastructure Management System. And, Gearflow.com plans to use its seed funding to streamline parts procurement for the construction industry.

Congratulations to each of these rapid-growth organizations! Follow the links below to learn more about each company and to browse open roles.

project44 — $202M | Series E

ShipBob — $200M | Series E

G2 — $157M | Series D

Rise Science — $10M | Series A

oak9 — $5.9M | Seed

Gearflow.com — $10M | Seed

Rheaply — $2.2M | Venture - Series Unknown

EdgeMode — $1.6M | Venture - Series Unknown

Spotivity — $1M | Seed

Chicago Startups Raised Nearly $300M in Venture Capital Deals in May 2021

The theme this May for newly venture-backed startups was “digitizing professional services.”

Chicago startups raised nearly $300M in seed and venture capital funding across 10 deals. The top 5 deals were made by logistics technology (FarEye), digital banking technology (Amount), and three niche insurance organizations (Kin, Obie, Evertas).

The nearly $300M raised in May bumped the total sum-to-date in 2021 to $1.6B, surpassing the 2020 funding total of $1.4B. A lot of the growth can be attributed to the increase in deals breaking $100M.The Chicago startup business market is flush with funds, brilliant ideas, and opportunities to make strategic alliances.

Congratulations to each of the following companies on their business growth! Click the links below to learn more about each company and to browse open roles.

FarEye – $100M | Series E

Amount – $99M | Series D

Kin Insurance – $63.9M | Series C

Obie – $10.7M | Series A

Evertas – $5.8M | Seed

MUSH Foods – $4.2M | Venture Unknown

Grove Biopharma – $4M | Seed

BluePallet – $4M | Seed

Tiv – $3.5M | Seed

Purchasing Platform – $2.5M | Venture Unknown

Chicago Startups Raised Over $844M in Venture Capital Deals in April 2021

Chicago startups made history in April. Last month, an unparalleled monthly sum exceeding $844 Million was raised across 22 Seed and Venture Capital deals. In total, April deals nearly doubled the total funds raised throughout Q1 and brought the current annual investment sum up to more than $1.3B.

Top deals were all made by various technology organizations, offering modern solutions for digitizing services. Top-deal-makers include ActiveCampaign’s $240M Series C funding round with investors Tiger Global, Dragoneer, Susquehanna Growth Equity, and Silversmith Capital Partners. Another 9-figure deal was made by Clearcover, who closed a $200M in Series D funding.

2021 continues to elevate Chicago as a hub for technology start-ups to catapult business and team development.

Click The Links Below To View Open Careers At These Rapid-Growth Organizations:

ActiveCampaign – $240M | Series C

Clearcover – $200M | Series D

HomeX – $90M | Funding Round

Hazel Technologies – $70M | Series C

Evozyne – $54M | Venture Series Unknown

Catch Co. – $38M | Series B

Fyllo – $30M | Series B

Arturo – $25M | Series B

Bartesian – $20M | Series A

Aclaimant – $15M | Series B

Dom's Kitchen & Market – $15M | Venture Series Unknown

Hallow – $12M | Series A

Investor Cash Management – $9M | Series A

Logiwa – $8.5M | Series A

Avant – $3.9M | Venture Series Unknown

Torch – $3.5M | Seed

ExplORer Surgical – $2.5M | Venture Series Unknown

Certiverse – $2M | Seed

Caddis Funding – $1.7M | Series A

New Era ADR – $1.6M | Pre-Seed

PreFlight – $1.2M | Seed

Volexion – $1.1M | Seed

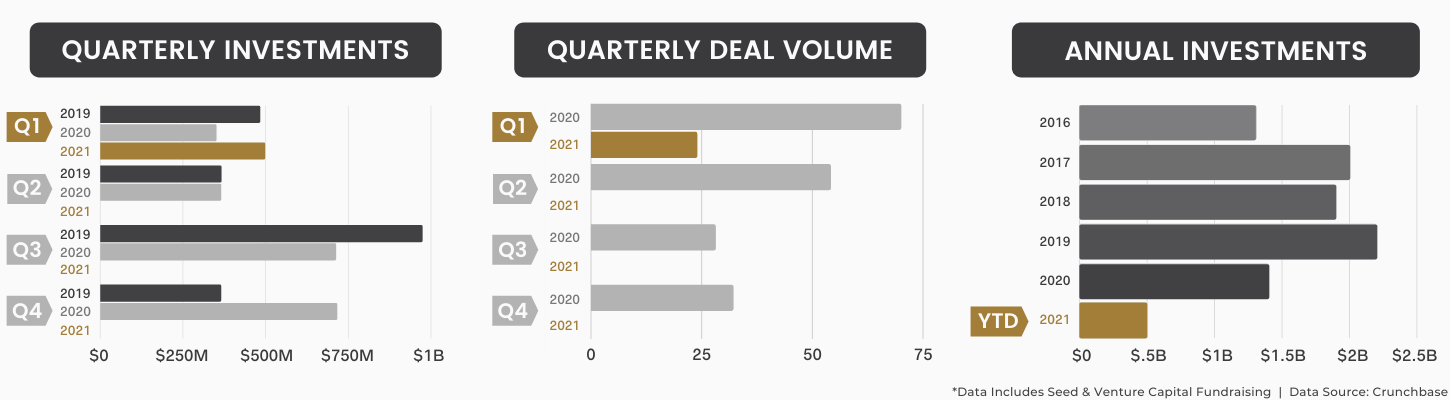

Q1 2021 was a Strong First Quarter for Chicago Startups

Compared to the opening quarter of the prior two years, that is. Already in 2021, Chicago startups raised about $498 Million in Seed and Venture Capital investments across 25 deals. This figure compares to $351M raised in Q1 of 2020 and $483M in Q1 of 2019.

Looking back on 2020, there is an interesting inverse relationship between the capital raised, and the volume of deals brokered each quarter. About 33% of the total deals brokered were made during the second half of 2020; yet, 66% of the capital funds were raised simultaneously. Q1 2021 appears to follow the lower volume (25 compared to the rolling quarterly average of 41.8) and higher-value investment pattern.

The most significant deals made in Q1 of 2021 include Cameo’s $100M Series C Venture, FourKites’ $100M Series D Venture, and M1 Finance’s $75M Series D Venture - all three deals made in March 2021.

It will be interesting to watch if deal volume picks up throughout the year. And if that is the case, will the average capital investment sum decrease, or will we continue to see major deals being made? We wish the best for all Chicago startups pursuing a similar growth journey.

Chicago Startups Raised Nearly $350M in Venture Capital Deals in March 2021

Last month, Chicago startups made some spectacular deals, funding nearly $350 million. This is the greatest monthly amount raised by Chicago startups this year. In fact, the March fundraising sum beat out eleven out of the twelve-monthly summaries in 2020.

The two top-deal-makers, Cameo and FourKites, each closed an impressive sum of $100M. Many of these brands have established a reputation in the Chicago tech start-up sphere, and we look forward to monitoring some of the newer companies, that have recently achieved Seed and Pre-Seed funding.

Congratulations To All Of These Rapid-Growth, Chicago Companies:

Cameo – $100M | Series C

FourKites – $100M | Series D

M1 Finance – $75M | Series D

Snapsheet – $30M | Series E

Xeris Pharmaceuticals – $27M | Post-IPO Equity

Leaf Trade – $5.5M | Series A

AeroPay – $5M | Venture Series Unknown

Tripscout – $2.3M | Seed

86 Repairs – $2M | Seed

Quicklly – $1.275M | Pre-Seed

Chicago Startups Raised Over $98M in Venture Capital Deals in February 2021

February 2021 was a great month for Chicago startups. Throughout the short month, companies announced over $98 Million in Venture Capital deals, a total nearly doubling the January 2021 round-up and well surpassing the ~$75 Million raised in February 2020.

February’s funding leader, FoxTrot, a startup that operates physical corner stores and one-hour delivery in neighborhoods across Chicago, announced plans to double its store count with new funding ($42M raised in February and $62M in total). Tovala, the smart oven and meal kit service, also announced expansion plans with their eyes set on Utah to open a second facility to serve the western U.S. Two tech brands, Rheaply and FingerprintJS, raised Series A funding, and five startups achieved seed capital.

Congratulations To Each Of These Companies For Achieving A Great Growth Milestone:

Foxtrot – $42M | Series B

Tovala – $30M | Series C

Rheaply – $8M | Series A

FingerprintJS – $8M | Series A

Prisidio – $3.3M | Seed

Everywhere Apparel – $2,985,677 | Series Unknown

Upkey – $2.6M | Seed

Anthill AI – $1.24M | Seed

WealthBlock – $250k | Seed

Social Market Analytics – $35k | Seed

Chicago Startups Raised Over $50M in Venture Capital Deals in January 2021

January Venture Capital fundraising deals are here. Last month, Chicago startups raised nearly $50 million in Venture Capital deals.

Congratulations To These Five Companies On A Great January:

Ocient – $40M | Series B

Dina Care – $7M | Series A

Litera Microsystems – $2M

Broadleaf Software – $500k | Seed

FeeBelly – $200k | Pre-Seed