Chicago VC Fundraising Summary 2022

Chicago Business VC Fundraising $ummary

✘

2022

✘

Chicago Business VC Fundraising $ummary ✘ 2022 ✘

Each month, HirexHire recaps Chicago startup funding. Which startups closed what deal and for how much money? Our team is passionate about supporting startup growth by connecting candidates with Chicago tech jobs and providing employers with talent recruitment solutions after securing new funding. If you need support recruiting top talent, contact us.

2022 Chicago Startup Seed and Venture Capital Fundraising Summary

JANUARY | FEBRUARY | MARCH | Q1 SUMMARY | APRIL | MAY | JUNE | Q2 SUMMARY | JULY | AUGUST | SEPTEMBER | Q3 SUMMARY | OCTOBER | NOVEMBER | DECEMBER | Q4 SUMMARY

Chicago Startups Raised Over $1B Seed and Venture Capital in Q4 2022

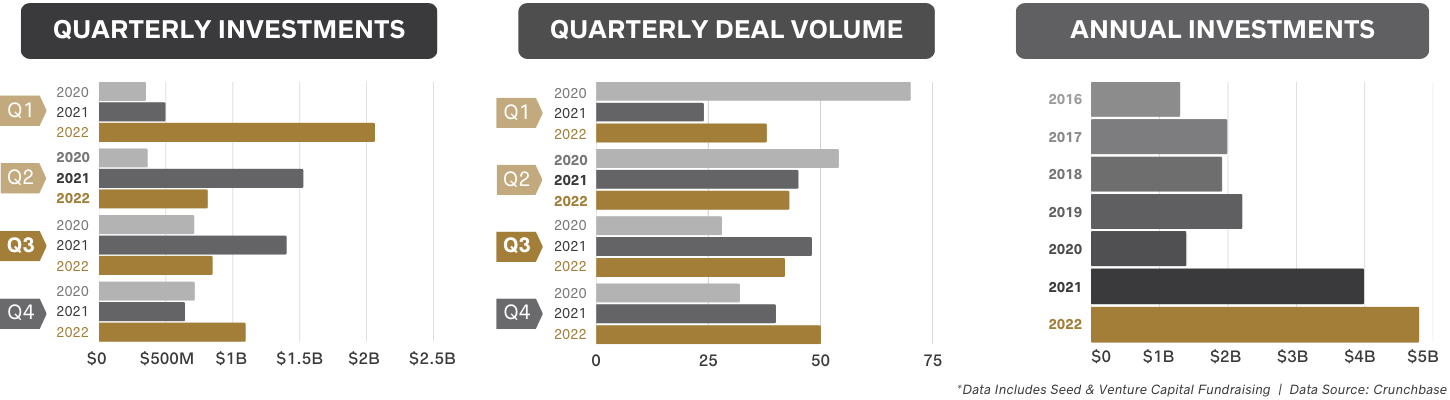

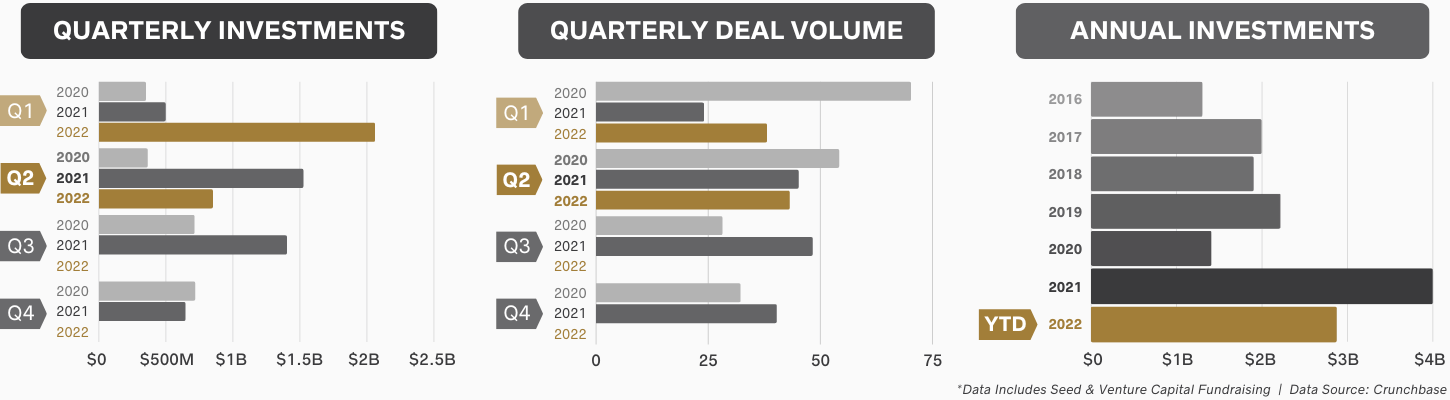

Forty-nine Chicago startups raised $1,094,252,701 in Seed and Venture Capital investments in Q4 of 2022, which is an increase compared to Q2 and Q3. Additionally, that closed the year with a record breaking total annually of $4.8 for 2022 (2016, $1.3B; 2017, $2B; 2018, $1.9B; 2019, $2.2B; 2020, $1.4B; 2021, $4B; 2022, $4.8).

On a broader scale, startup investment fell sharply in the fourth quarter, closing out 2022 far below 2021’s record setting levels. However, early stage investment continued to increase in the Midwest with Chicago leading the charge - a clear sign of strength in our tech community.

The top deals made in Q4 were made by Emalex Biosciences ($250M), Paragon Sciences ($185M), Nerdio ($117M), and Tempus ($100M). The biotechnology industry led the race of investments for the quarter, with 3 out of the 4 top investments.

Contact HirexHire to discuss recruitment solutions to sustainably scale your team. If you’re seeking a job in Chicago tech or professional services, view our job board.

Chicago Startups Raised Over $264M in December 2022

December was a month full of advancement and growth for Chicago-based startups, with 19 companies raising $264,379,867 dollars in seed and venture capital investments. These deals included industries in FinTech, BioTech, E-commerce, and more!

Coming in with the highest deal is Nerdio, a Microsoft ISV cloud-based technology company. Nerdio topped December, raising $117M in their series B round of funding. Throughout two rounds, they have raised a total of $125M, with the addition of one recent investor, totaling them at 3. The runner-up goes to Hunt Club, with $40M in their Series B capital. Hunt Club is a SaaS company offering software specialized in recruiting talent. This month featured quite a few companies in their seed round of funding, including Mezo, a property maintenance tech company, raising $6M.

This month included four technology companies with a focus on financial services technology. These companies are K1X, a SaaS FinTech company, which raised $15M; Evertas, a crypto insurance company, which raised $14M; DigitalWill.com, an application storing digital assets, which raised 3M; and ML Tech, a crypto asset trading platform, who raised $1.9M.

Other companies with significant advancement are CardioSense, a disease-preventative biotech company, which raised $15.1M; Trala, an EdTech music application company, which raised 11.2M; and Telegraph, a SaaS Supply Chain and Logistics company, which raised $11.2M.

Congratulations, December Dealmakers!

Chicago Startups Raised Over $633M in November 2022

Throughout November, nineteen Chicago-based startups raised $633,469,835 in Seed and Venture Capital investments. Deal closers included BioTech, Marketing and Advertising, eCommerce, Blockchain, and more.

The top two deals were closed by Biotechnology companies. Emalex Biosciences earned the top spot, raising $250M Series D, led by Bain Capital, to fund Phase 3 clinical trials and the advancement of a new drug for Tourette Syndrome. Emalex Biosciences was started in 2018 by life science incubator, Paragon Bioscience, which was also an investor in the recent Emalex Biosciences Series D round, and incidentally closed the second-largest deal in November, raising $185M Series according to Crunchbase. The bronze funding position was earned by the logistics technology company, Project44, closing an $80M round, led by Generation Investment Management and A.P. Moller Holding.

Four marketing and advertising companies closed deals in November, including market research and analytics companies, Attain and QualSights, and brand marketing companies, Gather Voices and Listener Brands.

A few companies in the eCommerce space also raised funding. Ecommerce order fulfillment software company, Logiwa, and online shopping website The Primo closed deals, as well as the property management procurement website, Purchasing Platform. Similarly, property maintenance management software company Mezo, and property management climate-risk reduction company, Green Shield Risk Solutions, also raised funds.

Two blockchain companies raised funding, Across Protocol and Kodex, as well as the two IOT companies, AHEAD and Keyo. The final funders include high-efficiency wireless hardware company, NuCurrent, education software company TeleTeachers, and chemical company, Låkril Technologies.

Congratulations, November dealmakers!

Chicago Startups Raised Over $196.4 in October 2022

Eleven Chicago-based startups raised $196,402,999 in Seed and Venture Capital in October 2022. Deals were closed by Chicago businesses operating in Software Development, Biotechnology Research, Transportation and Logistics, Financial Services, and more.

Tempus, a leader in artificial intelligence and precision medicine, made the top deal in October, fundraising $100M. In total, Tempus has raised over $1.3 billion in venture investments. The number two spot was claimed by the mobile healthcare navigation platform, HealthJoy, raising a total of $60M in funding, led by a new growth equity firm, Valspring Capital. Another biotech research company, Walela, raised $50K in Seed. Walela’s vision is to stop unnecessary medical interventions to protect women and babies from potentially harmful procedures

Multiple software development and information technology organizations secured funding in October to enable continued product and team expansions including Quicket Solutions ($8M / Series Unknown), a cloud-based records management, workflow automation, and payments platform; LogRock Inc. ($2M / Seed), an online compliance hub for trucking companies; The Primo ($750K / Series A), an e-commerce website for consumers; Uptok ($300K / Pre-Seed), a Live Video Commerce platform that enables 1-on-1 video shopping sessions; and Bamboo Asset Management ($49.5K / Seed), a utility mobile wallet that helps to decentralized finance, NFTs, and the metaverse.

The final funders include two transportation and logistics companies: MVMNT ($20M / Series A) and newtrul, ($5M / Seed), and the mobile finance app, Normal, which raised $240K Pre-Seed with GoAhead Ventures.

Congratulations, October dealmakers!

Chicago Startups Raised Over $847 Million Seed and Venture Capital in Q3 2022

Forty-two Chicago startups raised $847,961,474 in Seed and Venture Capital investments in Q3 of 2022, and nearly half the deals were closed in September.

Globally, venture funding dipped last quarter to the lowest activity since Q1 of 2020. While Chicago investments showed a slight increase compared to the previous quarter, the half-1 cumulative funds ($3.72B) are still on track to exceed the record-setting $4B year in 2021.

The top Chicago deals were made by Atlas, Bluestar Energy Capital, and Strike. The global Software Development company, Altas, raised $200M Series B, led by the global investment firm Sixth Street Growth. Bluestar Energy Capital, an investment firm focused on early-stage greenfield projects addressing scarcity, raised $100M Series A. Strike raised $90M Series B. Strike's mission is to build a more connected financial world by allowing users to instantly send and receive money anywhere with no fees.

Contact HirexHire to discuss recruitment solutions to sustainably scale your team. If you’re seeking a job in Chicago tech or professional services, view our job board.

Chicago Startups Raised Over $544M in September 2022

Chicago-based startups closed out September as one of the most lucrative months for fundraising throughout 2022. Twenty startups headquartered in Chicago raised $544,578,359 in Seed and Venture Capital. Many deals were closed by Chicago businesses operating in FinTech, Consumer Packaged Goods, Healthcare and MedTech, Professional Services, and more.

The top spot was earned by Atlas, an HR technology platform that helps companies manage their global workforce. Atlas raised $200M Series B, led by the global investment firm, Sixth Street. Bluestar Energy Capital also made a 9-figure deal, raising $100M Series A investments by Great Bay Renewables and S2G Ventures. Bluestar energy capital is a global investor supporting energy transition.

A few more professional service and FinTech-related companies closed deals in September. Strike raised $90M Series B to continue the growth of its API to allow merchants to send and receive secure payments worldwide. Blockchain solution company, B+J Studios, and fintech company, Bridge Money, also raised funding in September. Other professional service funders include the market intelligence platform, Tegus; the self-service TV advertising platform, Vibe; and Salesforce product experience management, Primly.

Five healthcare, MedTech, and biopharma startups raised funds last month: Soda Health, Kalderos, Upfront Healthcare Services, ClostraBio, and Neopenda.

We also saw deals by a few CPG companies including ready-to-eat oats, MUSH Foods; experimental brewery incubator, Pilot Project Brewing; and cell-cultured meat startup, Clever Carnivore. Food-related compliance documentation company, FoodReady additionally raised venture funding.

The final funders include two industrial professional services: a project/construction management firm, Cotter Consulting, and a crowdsourced review site for freight brokers and shippers, CarrierSource. Lastly, repeat-raiser, Songfinch, raised Series A funding to continue connecting songwriters with consumers who desire personalized, professional-quality songs.

Congratulations, September dealmakers.

Chicago Startups Raised Over $151M in August 2022

10 Chicago-based startups raised $151,480,563 in Seed and Venture Capital in August 2022 to continue driving product innovation, team member recruitment and hiring, and general business growth. Deals were closed by Chicago businesses operating in Cannabis and Tobacco, Health-tech, FinTech, and more.

Revolution Global, a medical cannabis producer, made the top deal, raising $62.8M in venture capital. In total, Revolution Global has raised $118.2M in funding over 3 rounds. Black Buffalo, a smokeless tobacco alternative, earned the runner-up spot, raising $30M Series A capital. Another Chicago-based cannabis company closed a deal in August. The first vertically integrated minority-owned cannabis company, The 1937 Group, closed a $13M deal.

The additional seven dealmakers were all Chicagoland tech companies. KeyCare is a virtual care platform powered by Epic that raised $24M. Two FinTech companies closed Seed deals: AMP Global Clearing and TRaiCE Inc. Antihill.ai also raised Seed funding. The remaining funders are Casecheck, an implant supply chain automation company; Havoc Shield, a cyber security program for small businesses; and Anthill.ai, an employee text message communication company.

Congratulations, August dealmakers.

Chicago Startups Raised Close to $152M in July 2022

12 Chicago-based startups raised $151,902,552 in Seed and Venture Capital investment deals in July 2022. Deals were closed by growth-stage companies in Food-tech, Farm-tech, Health-tech, and more.

PriceLabs, a provider of dynamic pricing and revenue management solutions for the short-term rental industry, closed the largest deal of the month, raising $30M Series A, led by Summit Partners.

Two Chicago-based health companies raised funds: IMX Health and NutriSense. We also saw deals closed by multiple consumer marketplaces. Quicklly, an online Indian cuisine marketplace, raised Seed Funding, and Leaf Trade, a cannabis marketplace for cultivators, processors, and dispensaries, also raised funding. One Farm-tech company raised funds in July. Sabanto, Farming-as-a-Service autonomous machines, raised $17M Series A.

Additional retail and consumer-related tech companies that raised funds last month include Logiwa (Ecommerce WMS software), Options-Quant (fintech building trading infrastructure for retail traders) 86 Repairs (subscription service platform that manages equipment repair and maintenance for restaurants), and Transship Corp (B2B Automated freight forwarding for international shipments of perishable goods). Another logistics funder was Varcode, a company that provides cold chain monitoring solutions for temperature-sensitive products.

The final funder is Fly.io which offers an Application Delivery Network (ADN) intended to help website owners get connected with their customers easily.

Congratulations, July dealmakers!

Chicago Startups Raised Over $800 Million Seed and Venture Capital in Q2 2022

Forty-three Chicago startups raised $811,578,982.00 in Seed and Venture Capital investments in Q2 of 2022.

Globally, VC investments dropped off in Q2. While Chicago investments did dip in comparison to the previous quarter, the Half-1 cumulative funds ($2.87B) still position Chicago to have a record-raising year.

The top deals in Q2 were made by Sun King, StoicLane, and Revenova. The off-grid solar company, Sun King, raised $260M Series D, led by BeyondNetZero, the climate investing venture of General Atlantic. StoicLane is a private holding company that specializes in real estate and financial services. StoicLane raised over $81M in May. Revenova, a CRM-based transportation management system, raised a $63M round led by Viking Global Investors.

Contact HirexHire to discuss recruitment solutions to sustainably scale your team. If you’re seeking a job in Chicago tech or professional services, view our job board.

Chicago Startups Raised Nearly $128M in June 2022

17 Chicago-based startups raised $127,999,217 in Seed and Venture Capital investment deals in June 2022. We saw multiple deals made by travel and entertainment companies, retail and CPG, and of course - tech.

Who earned the top spot? Elevate K-12, a services company bringing live streaming to classrooms, raised a $40M Series C investment, led by General Catalyst.

A few of the other notable deals were closed by Dentologie, a tech-forward dental clinic, which raised nearly $16M; Atmos Labs, a gaming ecosystem, raised $11M; Tripscout, a travel entertainment platform, raised $10.25M; and Journera, a travel technology company, raised $10M.

The total investment raised in June was cumulatively lower than the previous months of 2022; however, the volume of Seed and Venture Captial deals closed was above the annual average.

Congratulations, June dealmakers!

Chicago Startups Raised Over $241M in May 2022

Throughout May, 15 Chicago startups raised $241,055,133 in Seed and Venture Capital investments. StoicLane, a private holding company for finance, insurance, and real estate businesses, earned the top spot, raising $82M. StoicLane also announced its acquisition of Triserv Appraisal Management Solutions in May.

A few companies have shared expansion plans following new funding. PatientIQ – a cloud-based software platform and patient engagement technology that automates the collection of patient-reported outcomes – has announced plans to use the $20M Series B funding to expand its platform and double its team by the end of the year. SaaS company Network Perception enables corporate compliance and cybersecurity managers to gain a complete view of their network security. Network Perception shared plans to use the $13M Series A financing to expand its commercial activities, address the OT network cybersecurity needs, expand into new international markets, and establish strategic partnerships to accelerate go-to-market growth.

Multiple fintech firms closed deals in May including Amount, which offers digital transformation solutions for financial institutions and were recently named one of the Top Fintech Startups in the Midwest 2022; Cambio, which offers financial rebuilding support for consumers; and Foresyte, a calendar and budgeting app to be released this July.

Two media-tech startups raised capital. StreamLayer, an online media platform that develops interactive viewing experiences for mobile video services, received an investment from Las Vegas Sands, the world’s leading developer and operator of integrated resorts. Showrunner, providing technology to power the future of film and TV production, also announced its Seed funding alongside plans to move from NYC to Chicago.

Tyson 2.0 and Hyfé Foods are both CPG companies that closed deals in May. Tyson 2.0 is a premier cannabis company formed with the legendary boxer Mike Tyson in 2021 and is headquartered at the Old Post Office in Chicago. Hyfé Food is a biotech company that produces ingredients by leveraging fungal fermentation to upcycle water byproducts from food manufacturers.

Other investments included deals made by two logistics companies (LogRock Inc. and MVMNT) and a tech and manufacturing company, Azumo.

Congratulations, May dealmakers!

Chicago Startups Raised Over $442M in April 2022

In April, 13 Chicago startups raised $442,524,632 in Seed or Venture Captial investment funds. The largest deal of the month raised funds to grow for good. Sun King raised a $260 million Series D led by BeyondNetZero. Sun King sells, installs, and finances solar home systems for the 1.8 billion off-grid and under-electrified consumers across Africa and Asia.

Multiple SaaS and professional services organizations secured funding in April to enable continued product and team expansions including Revenova, a cloud CRM-powered transportation management system for logistics and freight; Waltz Health, a digital health prescription and pricing company; Leaf Trade, a cannabis wholesale marketplace between cultivators/processors and dispensaries; Crafty, a workplace food and supplies management company; Cordelia Capital, providing owners with up-front capital to successfully exit their business; and Clockwork, an AI-powered financial modeling platform.

Two companies secured funding to advance new tech to improve employee engagement. Five to Nine is a platform that makes it easy for employers to create, manage, and evaluate workplace events and programs. Additionally, Percent Pledge is a platform to customize social impact programs for workplace philanthropy initiatives.

Last month, we also saw deals made by several entertainment tech companies. Live Bash broadcasts live events and uses blockchain to convert live performances into digital collectibles and non-fungible tokens (NFTs). In April, Live Bash closed two deals, totaling over $40M in new funding. Songfinch, a platform to buy custom songs from professional artists, raised its second Seed round, following a deal closed in January 2022. The third entertainment deal was a Seed round raised by Out of Office, a travel app for people to discover and share travel and restaurant recommendations.

Congratulations April dealmakers!

Chicago Startups Raised Over $2 Billion Seed and Venture Capital in Q1 2022

Q1 2022 was a historic quarter for Chicago startups. Thirty-eight companies raised $2,059,020,316.00 in Seed and Venture Capital investment deals. This sum is over 4x previous Q1 closings (2019, $483M; 2020, $351M; 2021, $469M). The greatest contributor to this record-breaking quarter was the $1.2B venture capital round closed between startup, Citadel Securities, and VC firm, Sequoia Capital. Other top deals include the $200M Series D investment in Loadsmart and the $105 Series D raised by Zero Hash.

If you need support strategically and sustainably scaling your rapid-growth organization, contact HirexHire to discuss our recruiting and hiring services. View our open job board if you’re seeking a job in growth-stage tech or professional services.

Chicago Startups Raised Over $268M in March 2022

Throughout March, 15 Chicago startups raised Seed or Venture Capital fundraising. We saw many repeat raisers, including the top deal made by the direct-to-consumer home insurance company, Kin Insurance. We also witnessed many first-time funders achieving their Seed funding status.

Since announcing its $82 Million Series D financing, Kin has shared plans to “continue to recruit top talent across all departments, expand its suite of insurance products, and bring its proprietary technology and direct-to-consumer model to additional states.”

A majority of the fundraising deals were made with Chicago tech startups within financial markets (Navier, Deep Systems, Social Market Analytics), workforce automation or optimization (Dscout, Thoughtful Automation, Amper Technologies), professional services (Kin Insurance, New Era ADR), or medical (TimeDoc Health, CancerIQ, MAIA Biotechnology).

Other funders include the creative desserts and dinner restaurant, JoJo’s Shakes; internet services provider to maritime ships at port or sea, K4 Mobility; coworking accelerator, Workbox Company; and the virtual community to connect experts with aspiring talent, Protégé.

Congratulations, March Dealmakers!

Chicago Startups Raised Over $247M in February 2022

Fundraising continues to trend up for Chicago startups. In February, 11 companies announced nearly a quarter Million in Seed and Venture Capital investment deals. The total sum of $247,615,577 closed last month more than double the $98M raised in February 2021 and the $75M in February 2020.

Loadsmart, a supply chain freight-technology company that moved its headquarters to the Loop late last year, announced the largest deal of the month - raising $200M in Series D financing. Loadsmart announced plans to use the new funding to rapidly expand its technology offering.

Additional February tech funders include: Ubiety Technologies, Thoughtful Automation, New Era ADR, Synapticure, Genesis Volatility, and Science on Call.

An unusual number of Industrial deals were announced in February: two piping manufacturers (Metraflex and Flexicraft Industries) and RhinoDox, a construction bid response management platform. Another less common industry was represented by LandscapeHub, an online marketplace to connect wholesale buyers and sellers to source and procure plans and landscaping materials. Landscape Hub has announced plans to double its headcount in the next year.

Congratulations, February Dealmakers!

Chicago Startups Raised Over $1.5B in January 2022

You read that right. 12 Chicago startups closed a total of $1,543,035,918.00 in Seed and Venture Capital deals last month.

The top deal was made by crypto company, Citadel Securities, for $1.15B. Citadel Securities closed a minority investment with Sequoia Capital and Paradigm investment firms. Two additional cryptocurrency startups raised Series investments: Zero Hash and Blockfills. The fourth blockchain company to raise funds last month was Avaneer Health, a member-based healthcare network built on blockchain technology.

Besides Blockchain, other hot markets included Retail (Foxtrot, Leap Services, and Oars + Alps) and Education technology (Certiverse and Bridge to College).

If your rapid-growth organization needs talent recruitment solutions, contact us. Or, if you are seeking a job in Chicago tech, view our job board.

Congratulations, January Dealmakers!